FuneralNet has merged with Frazer Consultants

We’ve brought together two of the best website providers in the industry to make yours better than ever.

FuneralNet is one of the largest providers of custom designed deathcare websites in the United States, also serving clients in Canada, Australia and Puerto Rico. Their history of innovation has helped revolutionize the funeral industry with advancements such as online obituaries, online ID of remains, and cremation websites. FuneralNet clients have moved to the powerful Frazer Consultants website platform.

FuneralNet has merged with Frazer Consultants

We’ve brought together two of the best website providers in the industry to make yours better than ever.

FuneralNet is one of the largest providers of custom designed deathcare websites in the United States, also serving clients in Canada, Australia and Puerto Rico. Their history of innovation has helped revolutionize the funeral industry with advancements such as online obituaries, online ID of remains, and cremation websites. FuneralNet clients have moved to the powerful Frazer Consultants website platform.

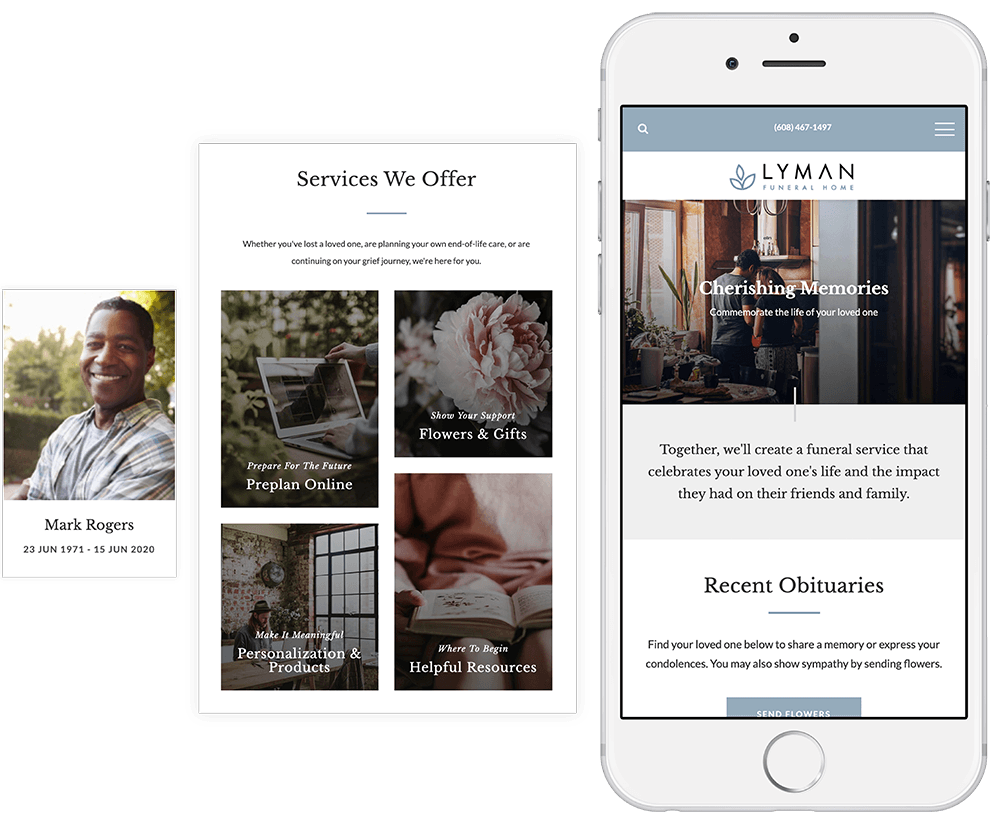

FuneralNet websites just got even better.

Experience the useful features you already know plus new, popular features from Frazer’s innovative websites.

Customize Your Design

Use the drag and drop builder to personalize your website to your brand.

Integrate with Software

Link your website with management software, digital marketing, eCommerce and more.

Manage From Dashboard

Easily update and manage your website all in one convenient dashboard.

Become ADA Compliant

Make your website accessible to all families, including those with disabilities.

Order Memorable Keepsakes

Families can order flowers and keepsakes such as holiday ornaments and tribute books.

Earn More Commissions

Take advantage of the highest number of conversions and revenue in the industry.

Host Interactive Obituaries

Families can share photos and messages, order flowers, and much more.

Increase Marketing Presence

Get found more on search engines and use the full marketing capabilities of your website.

Schedule a Demo to Learn More

New customers looking for FuneralNet solutions can contact Frazer Consultants at anytime for a free consultation to see the company can help their funeral or cremation business thrive with great technology and products.

Existing Customer and Need Support?

Existing FuneralNet clients can now get support by contacting:

Email: support@frazerGO.com

Phone: 1-866-372-9372